Localization strategy for global SaaS growth: Scaling beyond basic translation

How to scale from 1-2 languages to 20+ without losing speed or control

Most SaaS companies treat localization as a feature.

High-growth SaaS companies treat it as infrastructure.

A localization strategy for global SaaS growth is a structured approach to scaling languages, markets, workflows, and governance without slowing product velocity.

Translating your product into Spanish or German to test demand is relatively simple. Scaling to 10, 20, or 40 languages while shipping weekly updates is not. At that point, localization stops being a content task and becomes an operational growth system tied directly to revenue, retention, and expansion.

If you've already worked through the fundamentals in our localization strategy guide, ensured technical localization readiness, and implemented proper internationalization (i18n), this article focuses on the next challenge:

How do you turn localization into a repeatable growth engine for global SaaS?

The real shift: From translation project to growth system

Early-stage localization often looks like this:

- Export strings

- Send to a translator

- Import JSON

- Ship

That works for 1-2 languages.

Scaling localization looks different:

- Prioritize markets based on revenue potential

- Build a release pipeline that handles 15+ locales

- Maintain consistent terminology across product and marketing

- Reduce localization lag to near-zero

- Track revenue and retention per locale

That's not a translation workflow.

That's a growth system.

At scale, localization behaves like infrastructure: invisible when working, expensive when ignored.

Market selection is a business decision, not a language decision

Many teams ask:

"Which language should we add next?"

That's the wrong question.

The better question is:

"Which market creates the highest strategic upside?"

Language is execution.

Market is strategy.

In global SaaS, market prioritization determines ROI more than translation quality.

Signals worth taking seriously

Instead of guessing, analyze:

- Revenue concentration by geography

- Free trial signups by country

- Feature usage in non-English browsers

- Sales objections ("Do you support X language?")

- Regulatory requirements (finance, healthcare, public sector)

Example:

A B2B SaaS platform sees 14% of signups from Brazil but low conversion. Analytics show strong engagement but onboarding drop-off. Localizing onboarding and billing into Portuguese may unlock conversion; far more impactful than translating blog posts into five low-demand languages.

Localization connects directly to revenue when market selection is deliberate.

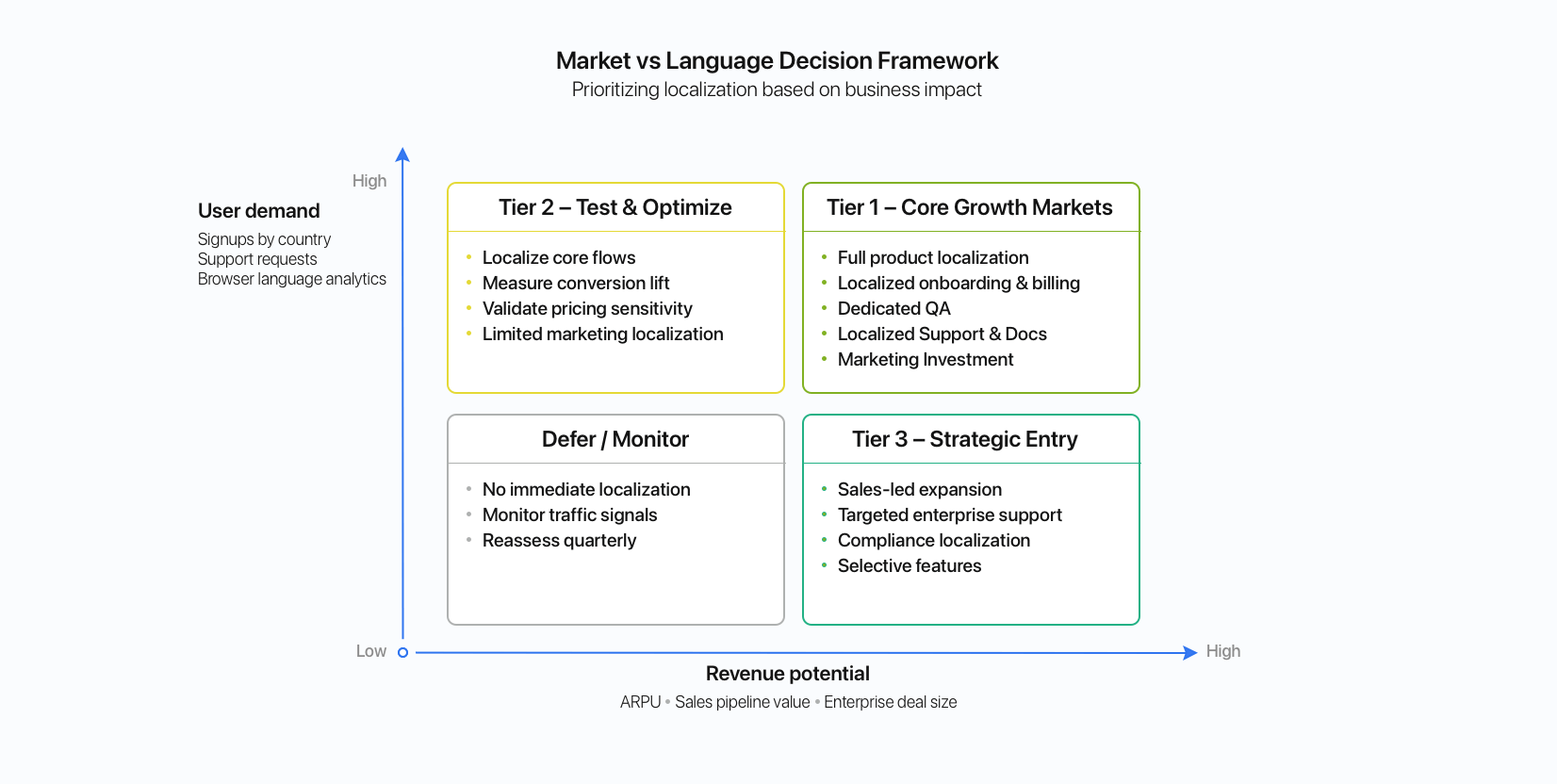

Use this framework during quarterly growth planning. Map your top 5 traffic markets onto the matrix and decide investment level per quadrant. Localization budget should follow strategic positioning, not noise.

Language rollout: Avoid the "20 languages at once" trap

Funding rounds and global expansion goals often trigger pressure to "go global" overnight.

That usually leads to:

- 12 partially translated languages

- No QA

- Broken UI layouts

- Overloaded support teams

Instead, think in tiers.

Tier 1: Core growth markets

- High revenue potential

- Dedicated QA

- Localized onboarding + billing

- Localized support docs

Tier 2: Expansion markets

- Strong demand signals

- Core product translated

- Limited marketing localization

Tier 3: Demand testing

- Machine translation + review

- Product-only localization

- Measured engagement before deeper investment

This phased approach protects quality while keeping expansion momentum.

If you're unsure whether your product is technically ready for this level of rollout, revisit the localization readiness checklist before scaling further.

Scaling workflows without slowing product velocity

The biggest risk of scaling localization?

It becomes the bottleneck.

Product ships weekly.

Localization ships quarterly.

That gap kills growth.

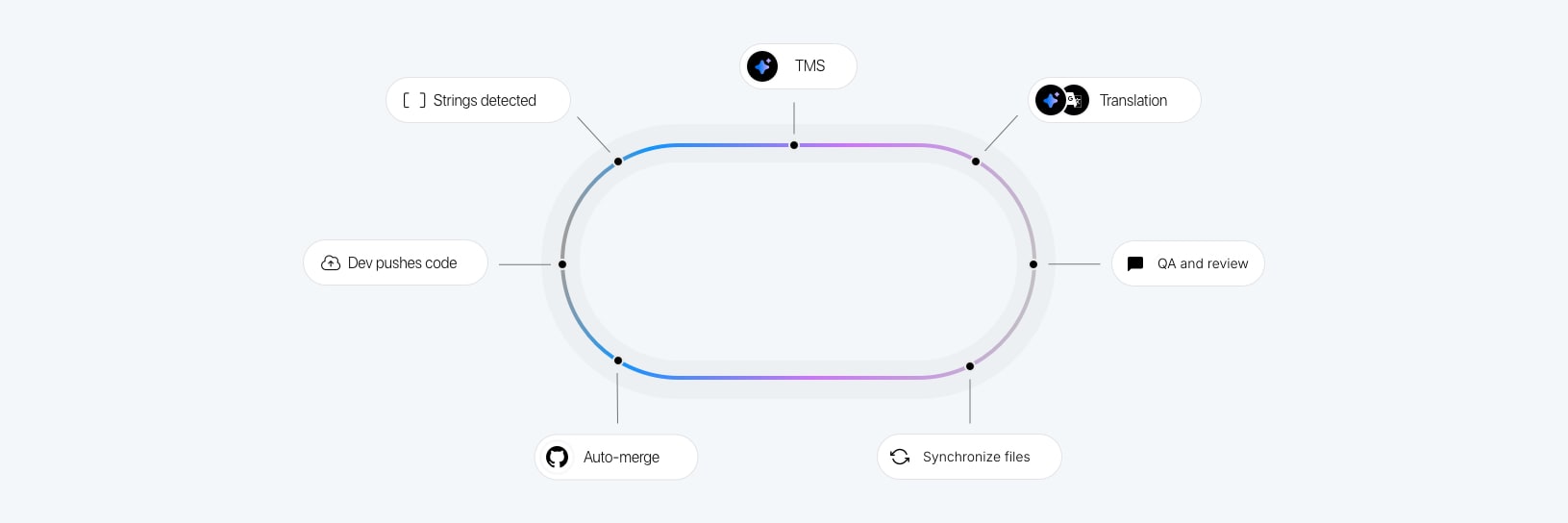

Localization must integrate into engineering workflows, not sit outside them.

What changes at scale

Small team:

- Manual exports

- Email-based reviews

- No translation memory

Scaling SaaS:

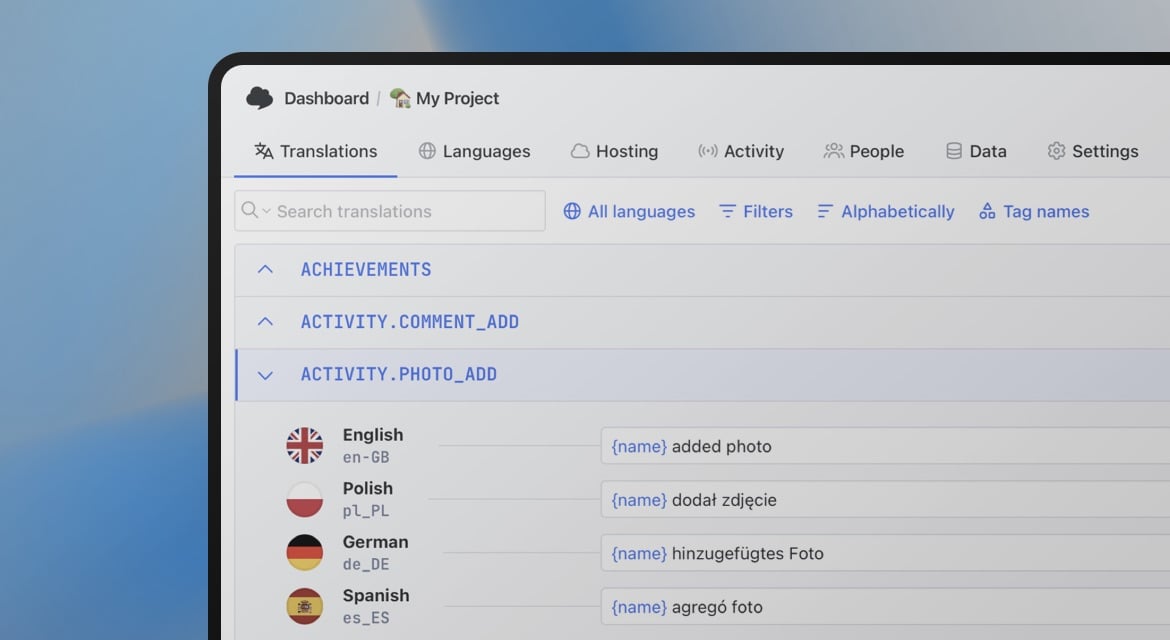

- Centralized TMS

- Translation memory reuse

- Automated string detection

- CI/CD integration

- Version-controlled localization files

When connected to CI/CD, new strings enter the translation queue during development, not after release.

If your team still confuses translation, localization, and internationalization responsibilities, revisit our breakdown of localization vs internationalization vs translation before scaling further.

Because no amount of translation quality can fix weak i18n foundations.

Governance: The invisible multiplier

Localization debt accumulates quietly when ownership is unclear.

Common symptoms:

- Marketing uses different terminology than product

- Two translations for the same feature

- No glossary control

- Support rewrites translations ad hoc

At 2 languages, this is annoying.

At 20 languages, it's chaos.

What mature governance looks like

- One defined localization owner (not “everyone”)

- Shared glossary enforced inside TMS

- Style guides per market

- Clear approval flows

- Release freeze rules for untranslated keys

Governance doesn't slow teams down. It reduces rework and protects consistency.

Quality isn't about grammar. It's about trust.

Users rarely churn because of one typo.

They churn when localization feels careless.

Examples SaaS teams underestimate:

- Truncated UI labels in German

- Incorrect plural rules in Slavic languages

- Wrong date format in billing

- Loosely translated legal disclaimers

This is where internationalization matters.

Weak formatting logic will break under scale.

Revisit your internationalization (i18n) guide if necessary before expanding further.

Measuring localization as a growth lever

If localization isn't measured, it becomes a cost center.

Tie it to business metrics.

Operational metrics

- Time to launch a new language

- % of untranslated keys at release

- Translation reuse rate

Growth metrics

- Conversion rate by locale

- Retention by region

- Revenue expansion per market

- Support ticket volume per language

Example:

A SaaS company localizes onboarding into Japanese and sees:

- +22% trial-to-paid conversion

- -18% onboarding-related support tickets

That's not translation ROI.

That's growth ROI.

Localization strategy belongs in quarterly growth discussions, not just release planning.

The most common scaling mistakes

Scaling SaaS teams often repeat the same errors:

-

Scaling languages before fixing i18n

Technical debt explodes.

-

Treating marketing and product localization separately

Terminology drifts.

-

No centralized translation memory

Costs increase every quarter.

-

Expanding faster than support capacity

Localized UI, English-only help center.

-

No exit strategy

Sometimes a language underperforms. That's data, not failure.

Scaling localization requires discipline as much as ambition.

Bringing it together: Localization as infrastructure

At scale, localization touches:

- Engineering pipelines

- Product UX

- Marketing messaging

- Customer support

- Legal compliance

- Revenue analytics

SaaS companies that treat localization as infrastructure scale languages predictably.

SaaS companies that treat it as translation projects stall.

The difference is strategy.

If you've mastered the foundations in the core localization strategy guide, the next step is operational maturity:

- Choose markets strategically

- Roll out languages in tiers

- Automate workflows

- Enforce governance

- Measure revenue impact

Do this well, and localization becomes a competitive advantage, not a recurring bottleneck.